Introduction: The Case for Consolidation

Over the last decade, retirement plans have undergone significant improvements, driven by innovations such as auto-enrollment, higher matching contributions, and curated fund line-ups that include simple investment options. These strategies have empowered more participants to save for their future and improved overall plan outcomes.

Yet, a new challenge has emerged alongside this progress: job mobility. With the average participant switching jobs more frequently, their retirement savings often become fragmented across multiple accounts, putting their financial security at risk.

Consolidation presents a unique opportunity for Retirement Plan Directors to address these challenges by keeping assets actively invested and engaged within the plan.

By studying the impact of seamless account consolidation, we’ve uncovered insights that not only benefit participants but also support a plan’s long-term success. Let’s explore how consolidation can drive better outcomes for plan participants and strengthen a company’s retirement plan.

The Challenge: Addressing the Gap in Seamless Transfers

Manifest, as the first and only plan-to-plan transfer tool, partnered with Washington University in St. Louis and other leading organizations to explore the impact of increased transfer rates. Our goal was to answer a crucial question: Can seamless plan-to-plan transfers drive meaningful value for participants while improving overall plan health?

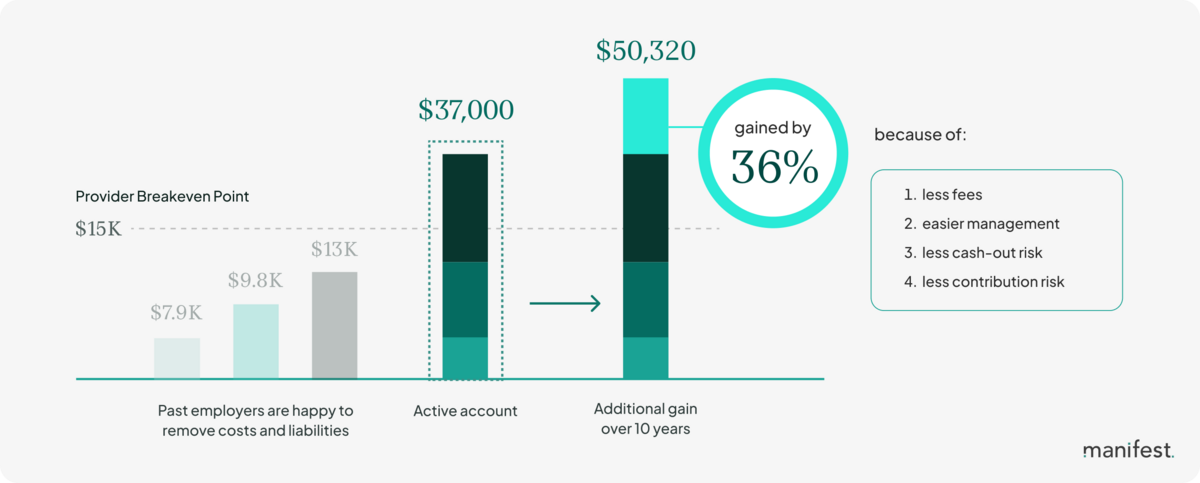

The findings were compelling. Transferring isn’t a zero-sum game—it creates a compounding effect, resulting in a 36% growth in participant balances over ten years.

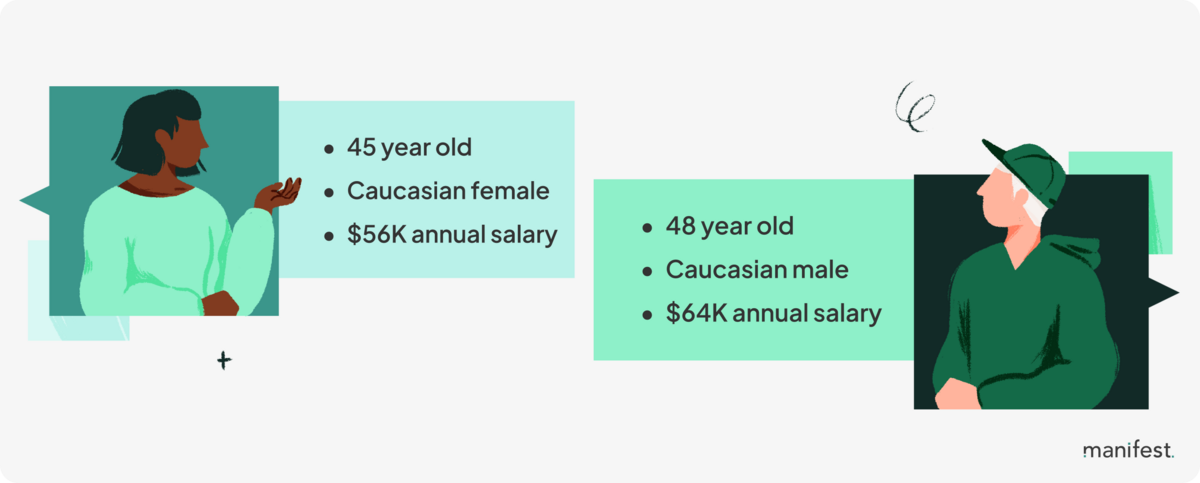

To understand how these participant benefits translate into stronger employer plan health, we conducted a detailed analysis of a retirement plan with 22,000 participants. Using three years of historical data, we established a baseline for participant activity and plan health:

These were the average participant demographics:

This employer’s diverse participant demographics provided a robust foundation for understanding the broader applicability of consolidation benefits.

Outcomes

Manifest is designed to engage participants through employer communication and our application. Our goal is to nudge participants toward maximizing their retirement outcomes by keeping their accounts actively invested and growing.

Increased average account balances

In 12 months of implementing our solution, Manifest grew balances plan-wide by an average of $13,450 per participant. There were three main drivers for this increase:

- An average of 2.8 accounts per active participant was consolidated into the plan. Manifest helped participants locate and organize old retirement accounts. By asking participants to input their previous employers (instead of remembering their usernames, passwords, and old providers), we helped participants find retirement accounts they often forgot they owned.

- Manifest cut non-emergency cash-out rates in half post-termination. We engaged inactive participants directly through their employer within six months of termination. By sharing the risks of non-emergency cash outs and decreasing the barriers to transferring, Manifest effectively nudged these participants to transfer.

- Manifest transferred an average of $57k into a plan per transfer. The average employer plan has a 1:10 roll-in to roll-out ratio. For every dollar put in, ten dollars are rolled out. Manifest was able to grow active account balances in 21 days to a balance that would’ve taken the users 4.3 years to save.

Changed participants' behaviors

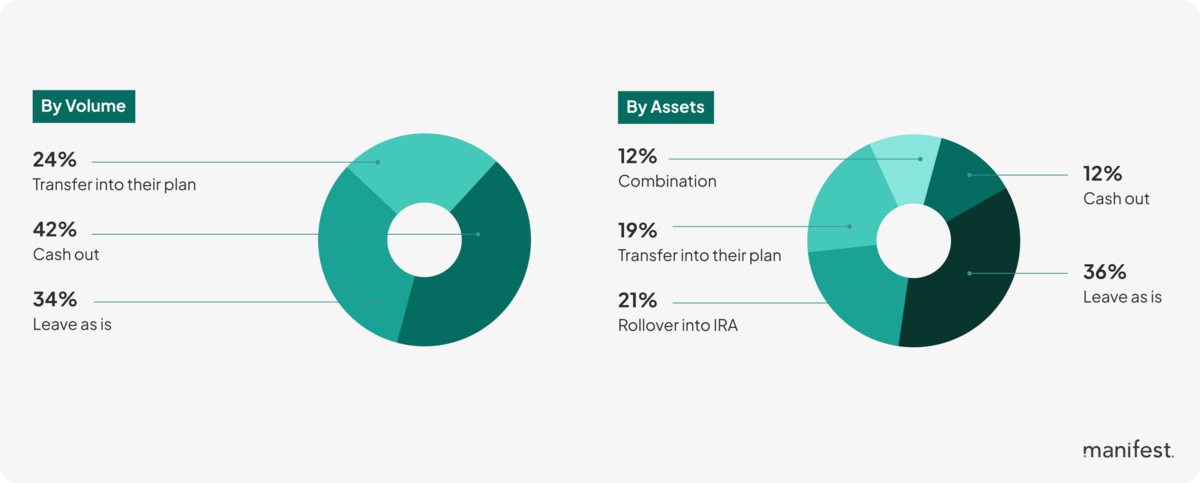

As the number of jobs in the average participant’s career grows, the actions they take with old accounts can help or hurt their nest egg. Based on historical data, the decision to transfer an account happens within the first two years of a participant joining or leaving an employer. While cashouts are common for lower balances, similar orphaned accounts are often left behind because of the complex transfer process.

- Communicated with participants within 60 days of onboarding or offboarding 4x transfer rates. When surveying participants, trust was the most influential factor when deciding when, where, and how to consolidate their accounts. Communication from the employer led to the most open rates. Avoiding conflicts of interest with an independent transfer agent led to the highest conversion.

- Participants wanted to take action, but their confidence in retirement transfers was low. We found that cashing out and leaving accounts behind are popular behaviors because of the complexities of terminology, decisions, and processes of consolidating accounts. Manifest learned that education isn’t particularly helpful in increasing confidence in the rollovers; however, decreasing the participant’s effort to transfer had the most impact on their confidence. Which also resulted in increased referrals between peers.

Increased participation

“Manifest unexpectedly increased our participants’ contribution rates — [it] was a pleasant side effect. We believe this speaks volumes to the pent up demand from our participants' perspective for a digital consolidation tool.”

Casey Cook, Head of Retirement Benefits

- Underrepresented groups made up a 1/4th of the plan, and increased their activity in the employer’s plan with Manifest. Underrepresented minority groups segmented by income, age, and gender often have lower tenure rates and neglect to contribute within a 401(k) plan. As a result, by increasing the portability of the benefit, we were able to increase contribution rates for those who have had historically lower tenures. This resulted in higher participation and engagement, contributing to longer tenures as well.

Expand on transfers

- 86% of participants post-termination increased loyalty with their existing provider. Manifest leverages many behavioral mechanisms to guide the user into different options. Out of all the factors, (1) fees, (2) investment options, and (3) reputation, the factor we found works best is the efficiency of transfers. As well as the trust they built with their existing RK. There was also a huge need discovered for mapping out securities, and that is something we’re still developing for testing in the future.

- Manifest reduced cashout rates by almost half post-termination. Transferring is a perfect time to foster smarter financial decisions. A survey with Northwestern Mutual found that after 150 people had used Manifest, they converted into life insurance products at a rate double the conversion rate of a Northwestern Mutual agent. This presents Manifest as a valuable up-selling opportunity for partner products, and shows we can increase financial wellness for everyone.

Conclusion

A participant can initiate a transfer using the Manifest application in less than 10 minutes, avoiding the seven hours of manual effort required today. Once initiated, only 14 days are needed for Manifest to process the transfer, as opposed to the current 60-day wait time. Without our tool, the process involves pen, paper, phone calls, and fax machines. Digitizing the experience gives participants more confidence to participate since their benefits are not tied to their employment, and 92% who initiate with Manifest successfully complete the transfer process.

Download the full whitepaper: Maximizing Retirement Outcomes Through Seamless Consolidation.

We would love to share more detailed employer and participant case studies! Just reach out to us here, and we can schedule a time to connect + share a demo.